What is a merchant service provider?

A merchant service provider (sometimes referred as MSP) is a link between a bank and any web established company which accepts credit card payments from other businesses or individuals, depending from the company’s products. Please don’t mix the term merchant service provider with merchant account provider. MSP business model very often includes the following:

- Merchant accounts provision

- Credit cards processing services

- Working only as an acquirer

- Simple payment processor

At the same time most of the merchant service providers are fully responsible for credit card and personal information storage, payment gateways, risk management, fraud identification and invoicing.

As it is very hard to say what kind of merchant services your business needs, our company cannot provide necessary information about the best merchant service providers (this information can easily be found online if you really want). EU Merchant Account deals with the whole process from scratch: we will find best solution to start accepting credit and debit card payments on your website, or we can review the merchant services which you are using now and provide with more efficient service in financial and timing terms. Our company does everything with a fresh start, and offers a personal support throughout the service connection procedure.

There are different providers, but most of them are focused on one particular business industry, for example on accepting payments from clients of Financial institutions where high risks are involved, meaning higher fees and more secure transaction encryption. Small internet shops are looking for simplicity and small fees, but they often forget about security, which in some case could cost you a lot if merchant service provider is not regulated by any commissions within the European Union. Our professionals are here to prevent your business from making big mistakes, which potentially could cost you extra 10% of income at the end of the year. It’s not just about number, it’s about the service your customers get, so don’t forget to put your customers first and then think about the service fees.

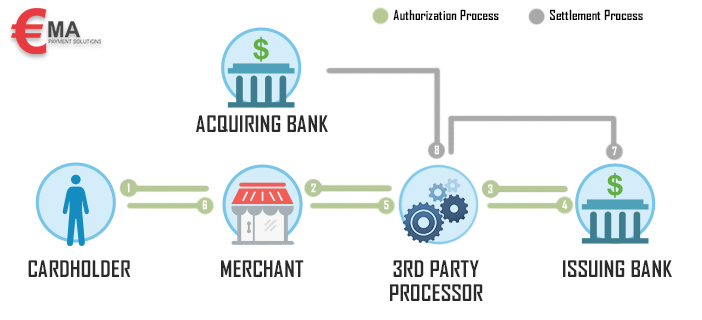

Cashflow within the internet transaction process is clearly shown on our figure below:

For ease of understanding we have numbered the steps of a transaction flow:

This service is nowadays fully automated and customers’ transaction could be accepted by the merchants within the seconds. Payments processing time depends solely from the transaction processing speed of the involved banks.

Merchant service provider hides within the term a lot of operations which are processed in a very small amount of time, so we hope that after this explanation you won’t ever ask what is a merchant service provider.

If you have any questions, please feel free to leave your comments below.